Lastly, don’t neglect to regulate for any one-off occasions or non-recurring sales that will not be reflective of ongoing enterprise. By doing so, you’ll refine the accuracy of your analysis, making certain that the insights you gather really replicate your business’s assortment and money flow situation. 🔎 You can even enter your terms of credit score in our calculator to match https://www.kelleysbookkeeping.com/ them along with your average assortment period. Suppose an organization generated $280k and $360k in internet credit score gross sales for the fiscal years ending 2020 and 2021, respectively. What’s extra, your common assortment interval contributes on to achieving company targets and growing your business.

- Set Practical Credit Score TermsStriking a steadiness between competitive credit terms and timely collections is crucial.

- Since the corporate must resolve how a lot credit score time period it should provide, it needs to know its assortment period.

- We Have helped clients like DNA Payments, 1Password, Deliverect and others to scale back overdue balance by 71% inside the first three to six months.

- Deciphering a company’s common assortment period includes evaluating it against the credit score terms extended to customers.

- A more detailed analysis entails reviewing the aging schedule of receivables and calculating the weighted average assortment period (WACP).

Comparison With Different Receivables Ratios

For particular person buyers, the Average Assortment Interval provides crucial insights right into a company’s monetary self-discipline and stability. Calculators and templates designed for the Average Collection Interval may be powerful allies in your monetary toolkit. They not only streamline the computation course of but in addition guarantee greater accuracy by minimizing the danger of manual errors.

What Is An Accounts Receivable Average Assortment Period?

Consequently, this will likely delay funds or result in larger defaults on invoices — resulting in longer common collection durations as corporations battle to collect on outstanding receivables. Legislation companies, for example, reportedly noticed an overall increase of 5% within the average collection cycle in 2023. Equally, inflation also negatively impacts shoppers and companies, typically leading to longer average collection periods. On the other hand, businesses that wrestle with longer assortment intervals average receivables collection period danger damaging relationships. Late funds impact a company’s cash flow and may create strained communication between the events involved.

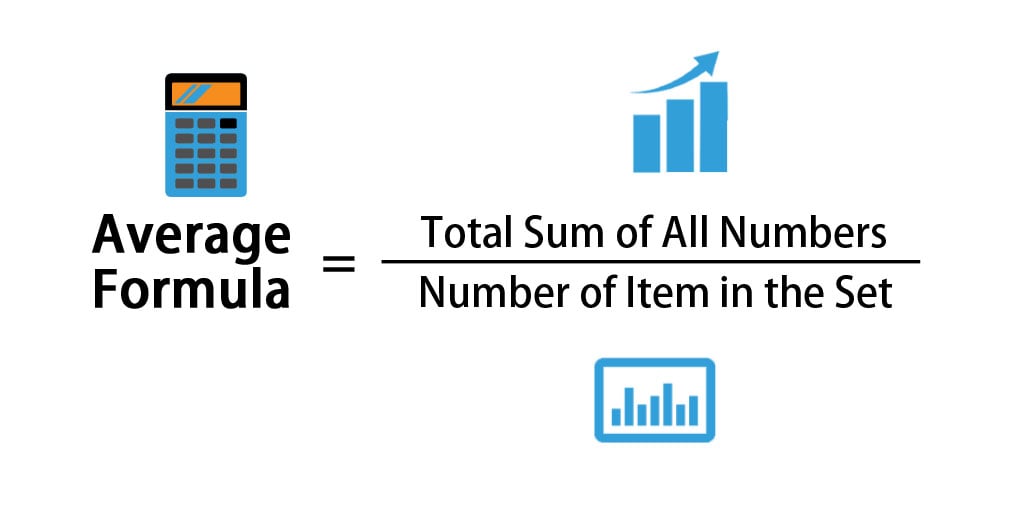

You also can open the Calculate average accounts receivable part of the calculator to search out its worth. 🔎 One Other common collection interval interpretation is days’ sales in accounts receivable or the common assortment interval ratio. Nonetheless, what constitutes a great collection interval additionally is dependent upon elements like business norms, customer payment behaviour, and the enterprise’s particular monetary goals. Regular monitoring and benchmarking in opposition to industry requirements might help determine and implement a great receivables’ collection interval tailored to the circumstances. It’s sensible to know tips on how to calculate your assortment interval, perceive what it means, and the means to assess the info so you’ll have the ability to enhance accounts receivable efficiency. When you log in to Versapay, you get a transparent dashboard of the present standing of all your receivables.

Common Assortment Period Evaluation

As it depends on revenue generated from these merchandise, banks will need to have a brief turnaround time for receivables. If they have lax collection procedures and policies in place, then revenue would drop, inflicting monetary hurt. Although money readily available is essential to every business, some rely more on their cash move than others. It is considered one of six primary calculations used to discover out short-term liquidity, that’s, the flexibility of a company to pay its payments (current liabilities) as they come due. OneMoneyWay is your passport to seamless global funds, secure transfers, and limitless alternatives in your businesses success.

A quick collection period may not at all times be useful because it merely may mean that the corporate has strict payment guidelines in place. However, stricter collection requirements can end up turning some clients away, sending them to look for corporations with the same goods or services and more lenient fee rules or better fee choices. The Average Assortment Period represents the number of days that a company wants to gather cash funds from clients that paid on credit score. First, they can evaluation and strengthen their credit score insurance policies, guaranteeing that credit score phrases are clear, reasonable, and aligned with trade standards. When disputes occur, there might be usually a string of backwards and forwards phone calls that pulls out the method of coming to an settlement and getting paid. Collaborative AR automation software enables you to communicate immediately along with your prospects in a shared cloud-based portal, helping you resolve these issues effectively.